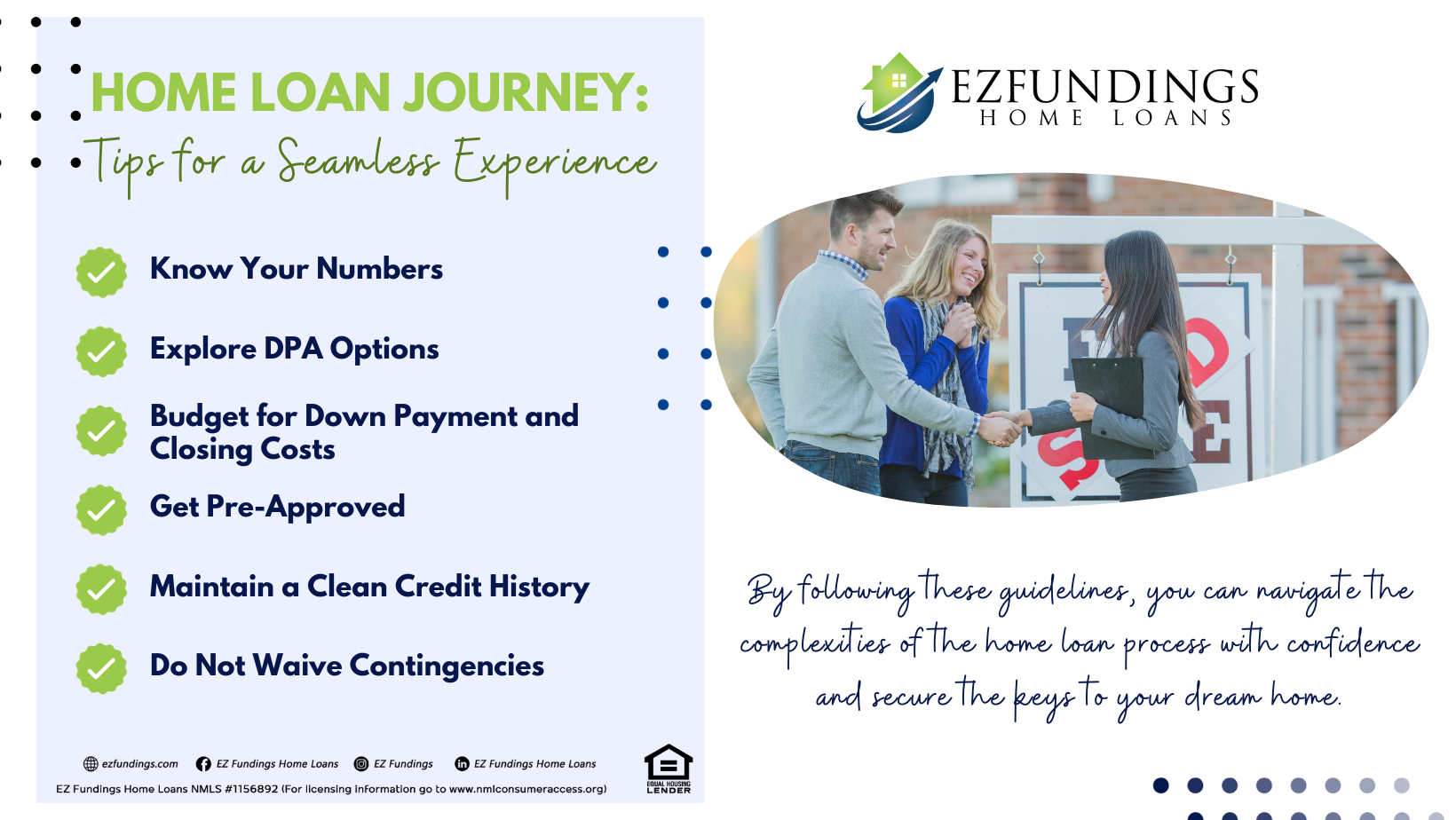

Acquiring a house is an important turning point in life. It entails obtaining a home loan for the majority of us. Thus, knowing the essential advice for a seamless home loan journey is essential whether you’re an experienced real estate investor or a first-time home buyer. We’ll go over some crucial advice in this post to help you make wise choices and guarantee a positive house-buying experience.

Know Your Numbers

Before diving into the home loan process, it’s imperative to have a clear understanding of your financial situation. Start by assessing your credit score, which plays a pivotal role in determining the interest rates you’ll qualify for. Request a free copy of your credit report and rectify any discrepancies to ensure accuracy. Additionally, calculate your debt-to-income ratio (DTI) to gauge your ability to manage mortgage payments. Knowing your financial numbers lays the foundation for a successful home loan journey. (Read about “Home Loan: No and Low Down Payment Options”.)

Explore Down Payment Assistance (DPA) Options

Saving for a down payment can be a daunting task. But, there are various Down Payment Assistance (DPA) programs available to help ease the financial burden. Research and explore government and non-profit programs that offer assistance to qualified homebuyers. Moreover, these programs can provide grants, low-interest loans, or other forms of aid, making homeownership more accessible. (Read and learn more about the “Down Payment Assistance Program”.)

Budget for Down Payment and Closing Costs

In addition to the down payment, it’s crucial to budget for closing costs. Closing costs include fees for services such as appraisals, inspections, and legal documentation. Having a clear understanding of these costs and incorporating them into your budget prevents any last-minute financial surprises. Furthermore, proper budgeting ensures that you are financially prepared for all aspects of the home buying process. (Learn more by reading “Home Loan Closing Costs and Their Inclusions”.)

Get Pre-Approved

Securing a pre-approval for a mortgage is a strategic move that gives you a competitive edge in the real estate market. A pre-approval letter demonstrates to sellers that you are a serious and qualified buyer. Moreover, it also provides clarity on the loan amount you can afford, narrowing down your home search to properties within your budget. Remember to shop around for the best mortgage rates and terms to secure the most favorable financing. (You read and learn about “The Power of a Pre-Approval for Home Loan” and “Mortgage Pre-Approval: Why It’s Essential and How to Get It”.)

Maintain a Clean Credit History

Your credit history is a crucial factor in the mortgage approval process. Lenders use your credit score to assess your creditworthiness and determine the interest rates on your loan. To ensure the best possible terms, maintain a clean credit history by paying bills on time, reducing outstanding debts, and avoiding new credit applications during the home loan process. ( Read and learn “Improve Your Credit Before Applying for a Mortgage”.)

Do Not Waive Contingencies

Some buyers may be tempted to waive contingencies to make their offer more appealing to sellers in the excitement of purchasing a home. However, contingencies serve as vital safeguards for buyers. They allow you to back out of the deal if certain conditions are not met, such as a satisfactory home inspection or appraisal. While waiving contingencies may seem like a shortcut, it can expose you to potential risks. Thus, it’s essential to weigh the pros and cons carefully before considering this option. (Find out more about “Contingencies in Today’s Buyer’s Market”.)

Get your copy of the First-time Home Buyer Guide for FREE. Click here.

Conclusion

In conclusion, the home loan journey is a significant undertaking that requires careful planning and consideration. Knowing your financial numbers, exploring DPA options, budgeting wisely, obtaining pre-approval, maintaining a clean credit history, and being cautious about contingencies are all essential tips for a successful and stress-free home buying experience. By following these guidelines, you can navigate the complexities of the home loan process with confidence and secure the keys to your dream home. ( Learn more about “The Impact of Homeownership on Personal Finances”.)