For Veterans, Active Duty or Blue Star Families

Reserve your Hometown Hero Credit now.

The Hometown Hero Credit

covers up to

$21,000

to help with the purchase of a home!

No repayment of the funds

No increase in interest rate

No extra qualifying requirements

Not limited to first-time buyers

The Hometown Hero Credit

covers up to

$21,000

to help with the purchase of a home!

No repayment of the funds

No increase in interest rate

No extra qualifying requirements

Not limited to first-time buyers

Reserve your Hometown Hero Credit now.

BOOK A ONE-ON-ONE PHONE CALL WITH US TODAY

Let us honor you, our service members, with something real and tangible, schedule with us now!

The Hometown Hero Credit Program can save you up to $21,000 on a VA Loan, and up to $6,000 (ZERO Origination Fee) and give you one of the lowest Note Rates in the industry on a Reverse Mortgage.

Escrow

Escrow

![]() Title

Title

![]() Lender

Lender

![]() Underwriting

Underwriting

![]() Processing

Processing

![]() Notary

Notary

![]() and any buyer related fees

and any buyer related fees

We are now licensed in:

Alabama, Arizona, Arkansas, California, Colorado, Florida, George, Idaho, Illinois, Maryland, Michigan, Ohio, Oregon, Pennsylvania, Tennessee, Texas, Utah

JOIN OUR AMAZING GROWING TEAM!

We are now licensed in:

Alabama, Arizona, Arkansas, California, Colorado, Florida, Georgia, Idaho, Illinois, Maryland, Michigan, Ohio, Oregon, Pennsylvania, Tennessee, Texas, Utah

Join our amazing growing team.

Together with our Brand Ambassador JOIN WITH US!

BRADLEY STACY

The Hometown Hero Credit is a program of Operation T.A.G. (Tangible Act of Gratitude) and administrated by LLBD. Brett Stacy, the CEO was recently interviewed by CNTV.

Reserve your Hometown Hero Credit of up to $21,000 on your VA loan or up to $6,000 (no origination fee) and one of the lowest note rates in the industry for your Reverse Mortgage. Call us today!

Let the Hometown Hero Credit save you thousands and/or give you one of the best rates in the industry.

The Hometown Hero Credit $21,000 Grant

Are you a Veteran, Active Duty or Blue Star Family member?

LLBD Hometown Hero Credit Military Grant

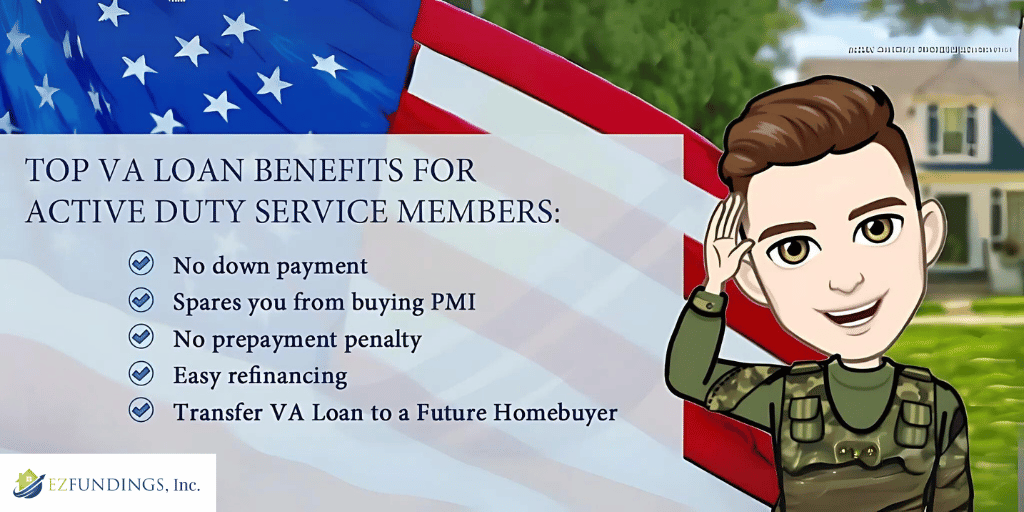

My Benefits as an Active Duty Service Member for VA Loans

Backed by the Department of Veteran Affairs, VA loans offer tons of benefits as an active duty service member and veteran that wish to become homeowners. Read on to learn how you can benefit, as long as you meet the criteria.

VA Home Loans: Benefits of a Spouse

The veteran’s family may be affected negatively after their demise in a military service casualty. It can be difficult for the surviving spouse to cope with the loss and provide for the family. The dream of homeownership may seem far-fetched. But don’t worry, the VA offers amazing benefits to the surviving military spouses, including the federal loan guarantee.

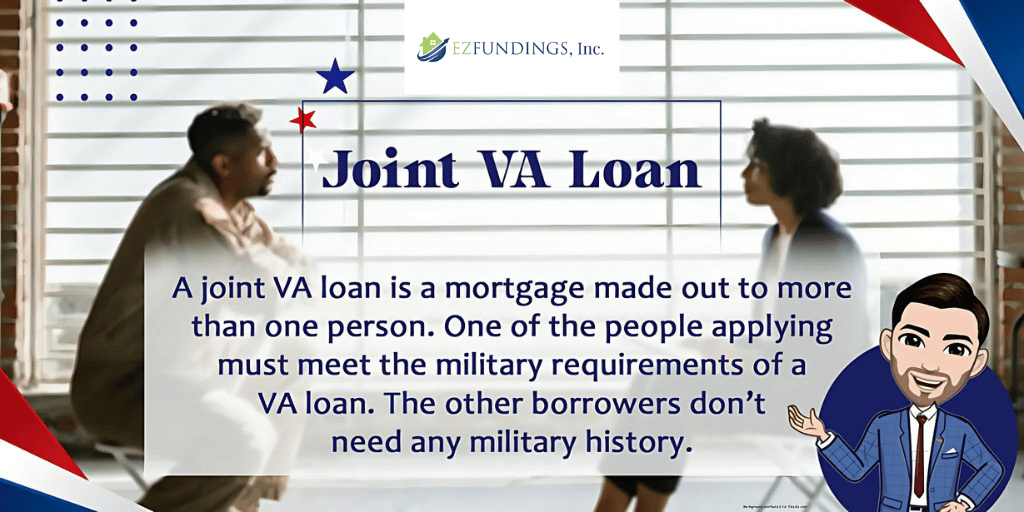

Joint VA Loan: What is it and How to Apply

VA Loans are an attractive mortgage option because they require no down payment. One of the challenges of a VA loan is that only members or veterans of the U.S military or the unmarried widow of a veteran to qualify for one of these loans. Unless you apply for a joint VA loan.

House Hacking: Using a VA Loan to Buy a Multi-Family Unit

One of the biggest benefits of a VA loan is the $0 down payment, but can a VA loan be used to purchase a duplex? What about a multifamily home? The answer to both questions is a resounding YES! However, certain conditions do apply. First, what are the benefits of utilizing your VA benefits to purchase a multi-unit property? Let’s go through them.

We Make Time for Everyone

We’re happy to get in touch with you on Mondays to Fridays. Your weekend is for you and your loved ones.

SUNDAY

CLOSED

MONDAY

9:00AM–5:00PM

TUESDAY

9:00AM–5:00PM

WEDNESDAY

9:00AM–5:00PM

THURSDAY

9:00AM–5:00PM

FRIDAY

9:00AM–5:00PM

SATURDAY

CLOSED

We Make Time for Everyone

We’re happy to get in touch with you on Mondays to Fridays. Your weekend is for you and your loved ones.

SUNDAY

CLOSED

MON

9:00AM–5:00PM

TUES

9:00AM–5:00PM

WED

9:00AM–5:00PM

THU

9:00AM–5:00PM

FRI

9:00AM–5:00PM

SATURDAY

CLOSED