VA Loans are an attractive mortgage option because they require no down payment. One of the challenges of a VA loan is that only members or veterans of the U.S military or the unmarried widow of a veteran to qualify for one of these loans. Unless you apply for a joint VA loan.

Joint VA Loan: What is it?

A joint VA loan is a mortgage made out to more than one person. One of the people applying must meet the military requirements of a VA loan. Meanwhile, the other borrowers don’t need any military history. But, both people that apply for this government-insured loan are responsible for the monthly payments.

These are a great option for applicants who don’t have enough or don’t want to come up with the money for a down payment. Besides, traditional VA loans don’t require any down payment. Moreover, the borrower with the military experience won’t have to make a down payment, too. However, the co-borrower who does not have military history will have to come up with a down payment for his/ her half of the loan.

These type of loan can include three main combinations:

- first, one person who qualifies for a VA loan can apply with one or more people who do not;

- second, two or more people who qualify for a VA loan with all applicants using their VA entitlements; and,

- third, two or more people who qualify for a VA loan with not all applicants using their VA entitlements.

Note: You do not need to apply for a joint VA loan if you’re applying with your spouse. Spouses are counted as one entity.

Joint VA Loan vs. Traditional VA Loan

The biggest difference between a joint VA loan and a traditional VA loan depends on the combination of applicants for the loan. The non-military borrower may have to come up with a down payment. This is if a veteran or active-duty military member is applying with an unmarried non-military borrower. The down payment is on the half of the loan that is not insured by the Department of Veteran Affairs.

This is because the Department of Veteran Affairs is only guaranteeing the portion of the loan that is being taken out by the borrower who qualifies for VA benefits.

Pros and Cons

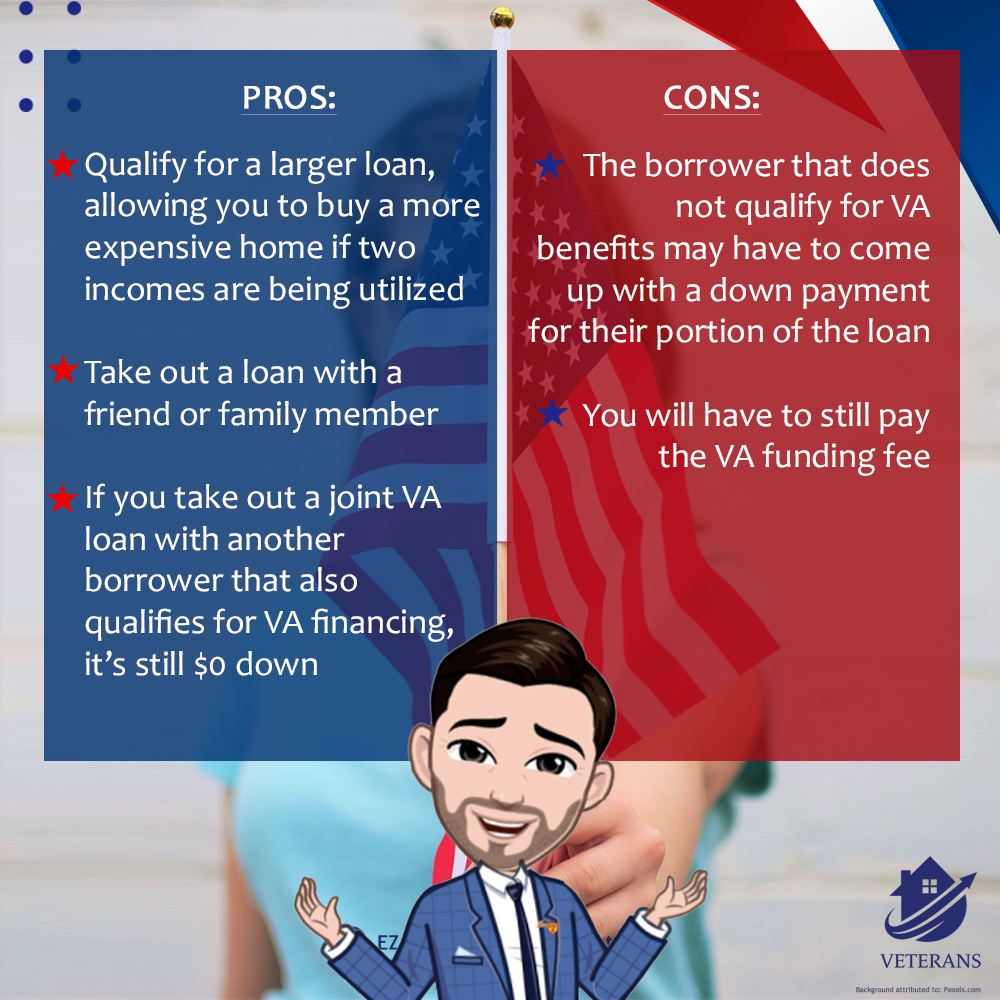

PROS:

- Qualify for a larger loan. Hence, allowing you to buy a more expensive home if two incomes are being utilized.

- Take out a loan with a friend or family member.

- It’s still $0 down. This is if you take out a joint VA loan with another borrower that also qualifies for VA financing.

CONS:

- The borrower that doesn’t qualify for VA benefits may have to come up with a down payment for their portion of the loan.

- You will have to still pay the VA funding fee.

A joint VA loan might be the choice for you if you’ve served in the military or are currently on active duty. Reach out today to learn more!