When it comes to purchasing a home or financing real estate, there are numerous strategies and tools at your disposal. One such strategy is the 2-1 buydown option, a financial tool that can significantly impact the affordability and appeal of a mortgage. In this article, we’ll go over the 2-1 buydown option, its advantages, and provide a real-life case comparable to help you understand the concept better.

How it Works

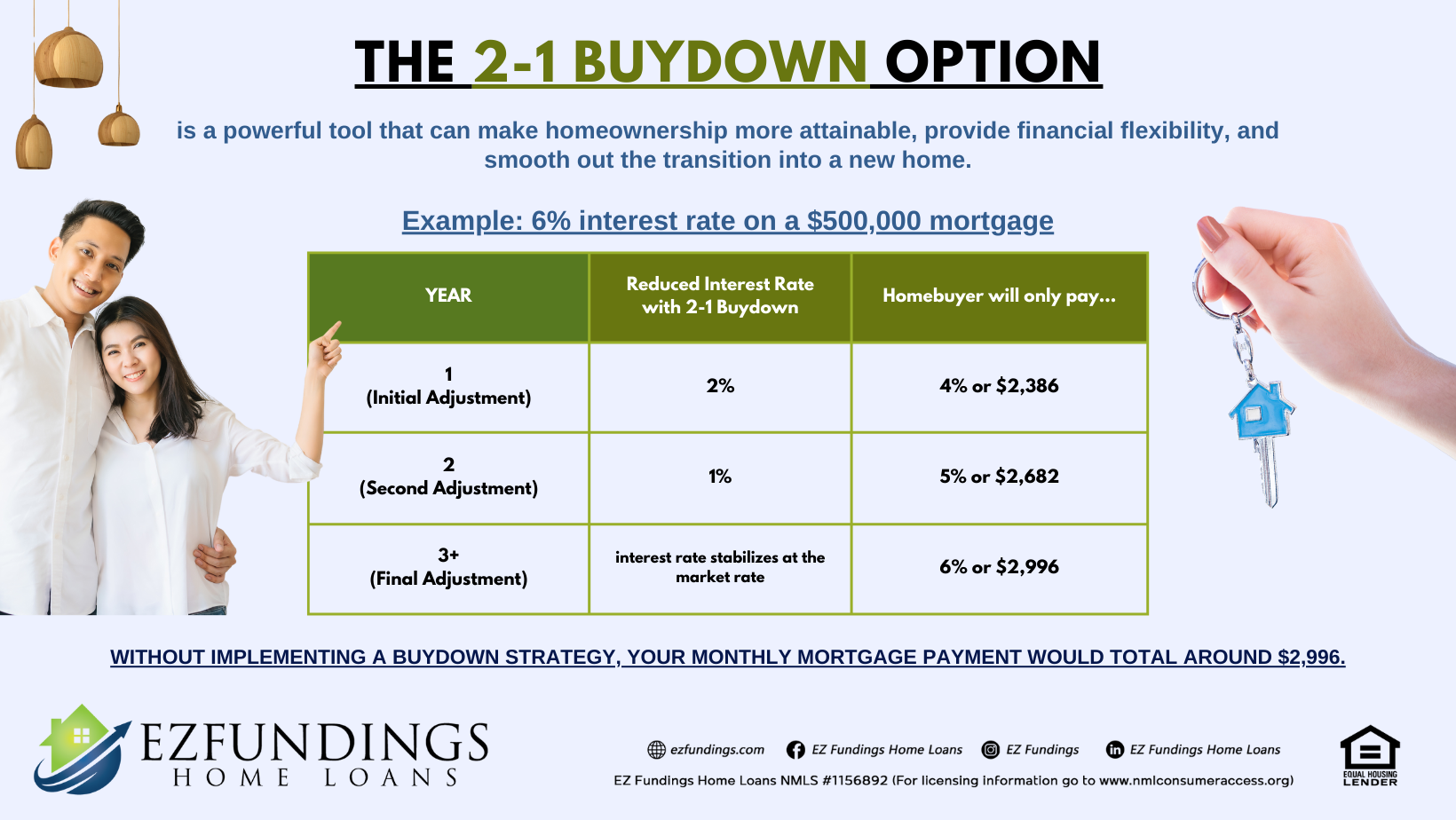

A 2-1 buydown option is a creative financing strategy that enables homebuyers to secure a lower interest rate and, consequently, reduce their monthly mortgage payments. Furthermore, The “2-1” in the term refers to the three years that this strategy typically spans.

Initial Adjustment

In the first year of the 2-1 buydown, the interest rate is reduced by 2% from the prevailing market rate. For example, if the market rate is 6%, the homebuyer will pay only 4% for the first year.

Second Adjustment

In the second year, the interest rate increases slightly by 1%, reaching 5% in our example.

Final Adjustment

Finally, in the third year and for the remainder of the loan term, the interest rate stabilizes at the market rate, which is 6% in this case.

The real magic of this strategy lies in the initial two years. Homebuyers can enjoy more manageable monthly payments by securing a lower interest rate at the beginning of the loan. Moreover, it will allow them to free up cash for other expenses or investments. (Learn more by reading “Choosing The Right Mortgage Lender: Five Factors To Consider”.)

Advantages

The 2-1 buydown option offers several compelling advantages.

Lower Initial Payments

This strategy significantly lowers the initial mortgage payments, making homeownership more accessible to many. Thus, it’s an excellent choice for first-time buyers who might not have a substantial down payment saved. (Read and learn more about “Home Loan: No and Low Down Payment Options”.)

Budgeting and Cash Flow

Homebuyers have greater flexibility in their budgets with lower initial payments. Furthermore, they can allocate funds to other priorities, such as home improvements, savings, or investments, during the first two years. (“Read and Learn more about “The Impact of Homeownership on Personal Finances”.)

Predictable Future Payments

It stabilizes in the third year and beyond while the interest rate increases in the second year. Thus, homeowners can plan their future budgets with more certainty, knowing their mortgage payments won’t fluctuate as wildly as with a standard mortgage.

Live Case Comparable

Let’s consider a real-life case to better illustrate the benefits of a 2-1 buydown analysis.

The Johnson Family Case

Meet the Johnsons, a young family embarking on their journey to own their first home. They’ve discovered their dream house. But, they’re apprehensive about the initial financial challenges that come with homeownership, especially with a 6% interest rate on their $500,000 mortgage.

Their monthly mortgage payment would total around $2,996 without implementing a buydown strategy. However, they decide to opt for a 2-1 buydown option. In the first year, their interest rate is lowered to 4%, resulting in a reduced monthly payment of $2,386. This decision alleviates the immediate financial strain. It allows them to channel more funds into setting up their new home and managing their daily expenses.

Moving into the second year, the interest rate inches up to 5%, leading to a monthly payment of $2,682. Despite this increase, they find it quite manageable, primarily due to the financial cushion they built during the first year.

Starting from the third year and onwards, their interest rate stabilizes at the market rate of 6%, resulting in a monthly payment of $2,996. By this point, the Johnsons are in a much more secure financial position, and the consistent payment no longer feels burdensome.

In this scenario, the 2-1 buydown strategy has empowered the Johnsons to transition into homeownership with grace, easing their financial burden, and enabling them to concentrate on creating a fulfilling life in their new abode. They did also request a Seller Credit to offset the costs of the 2-1 buydown, further enhancing their financial stability as they embark on this exciting journey.

Get your copy of the First-time Home Buyer Guide for FREE. Click here.

Conclusion

In conclusion, a 2-1 buydown option is a powerful tool that can make homeownership more attainable, provide financial flexibility, and smooth out the transition into a new home. Thus, this creative financing strategy is worth considering whether you’re a first-time buyer or looking to make your dream home more affordable. (Learn and discover “First-Time Home Buyer Tips”.)