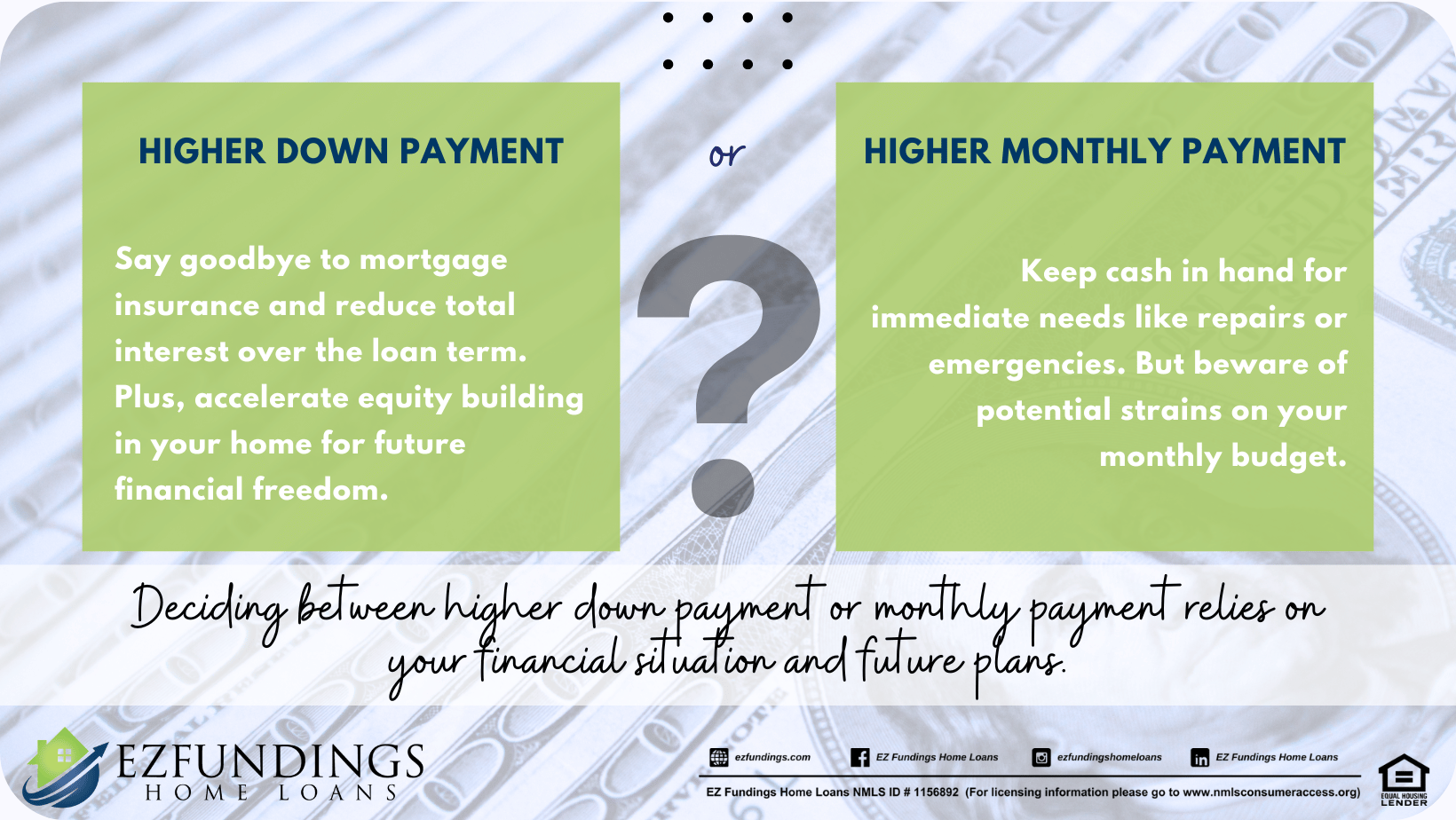

Deciding between a higher down payment or higher monthly payment is crucial when buying a home. Both options have unique advantages and disadvantages. Thus, here’s a closer look at how each choice can impact your financial situation and homeownership experience.

Higher down payment eliminates mortgage insurance

A higher down payment often means avoiding mortgage insurance. Mortgage insurance protects lenders if borrowers default but it adds to your monthly costs. Indeed, you can eliminate this expense and save money over time by putting it down. (Learn more by reading about “How to Remove Mortgage Insurance?”.)

Higher down payment reduces total interest paid over the loan term

Choosing a higher down payment lowers the loan amount and reduces the interest paid over the loan term. A smaller loan means less interest accrues of which can save hundreds of dollars. Furthermore, this option can be especially beneficial if you plan to stay in the home long-term. (Get insights about this “Higher interest rates or Higher purchase prices: Which one makes more sense”.)

Higher down payment accelerates equity building in the home

A larger down payment boosts your initial equity in the home. Equity is the portion of the home you own outright, and building it faster increases your financial stability. Thus, you have more borrowing power for future loans or home improvements with more equity.

Difficulty in saving for a higher down payment

However, saving for a higher down payment can be challenging. Accumulating a large sum of money takes time and discipline. Undoubtedly, this can delay homeownership and may not be feasible due to other financial commitments for many. (Discover about this “Homeownership with Low to No Down Payment Options!”.)

Higher monthly payment allows more cash for home repairs, furniture, and emergencies

Opting for a higher monthly payment can keep more cash in your pocket initially. This extra cash can be useful for home repairs, buying furniture, or handling emergencies. Definitely, it’s a practical choice if you need immediate liquidity.

Higher monthly payment has less strain on monthly budget

On the other hand, a higher monthly payment has less strain on your budget. Increased payments may limit your financial flexibility. Besides, it’s important to ensure you can comfortably afford these payments to avoid financial stress.

Decision depends on individual financial situation and goals

Choosing between a higher down payment or higher monthly payment depends on your financial situation and goals. A higher down payment might be better if you have substantial savings and prioritize long-term savings. Conversely, a higher monthly payment would suit you more if you need liquidity.

Consider both immediate and long-term financial impacts

It’s essential to consider both immediate and long-term financial impacts when deciding. A higher down payment reduces long-term costs but requires upfront cash. Alternatively, a higher monthly payment keeps more cash available now but increases long-term expenses.

Balance between upfront costs and ongoing affordability

Finding a balance between upfront costs and ongoing affordability is key. Neither option is inherently better; it depends on what you can afford now and in the future. Indeed, carefully weigh your ability to pay now against your future financial security.

Evaluate personal needs and financial flexibility before deciding

Evaluate your personal needs and financial flexibility before deciding. Think about your current savings, income stability, and long-term financial plans. Definitely, a thoughtful approach ensures that your decision supports your overall financial well-being.

Get your copy of the First-time Home Buyer Guide for FREE. Click here.

Takeaways

Whether a higher down payment or higher monthly payment is better depends on your unique circumstances. Clearly, you can make an informed decision that aligns with your financial goals and lifestyle by considering the points above. (Read to learn more about “The Impact of Homeownership on Personal Finances.”)