As a potential home buyer, it’s crucial to understand how even a small shift in mortgage rates can significantly affect your home buying power and monthly payments. The 30-year fixed mortgage rate has been fluctuating between 6% and 7% this year. Thus, let’s explore the connection between home buying power and changing rates, the benefits of homeownership, and the importance of growing equity in a home.

Impact of Changing Rates on Home Buying Power

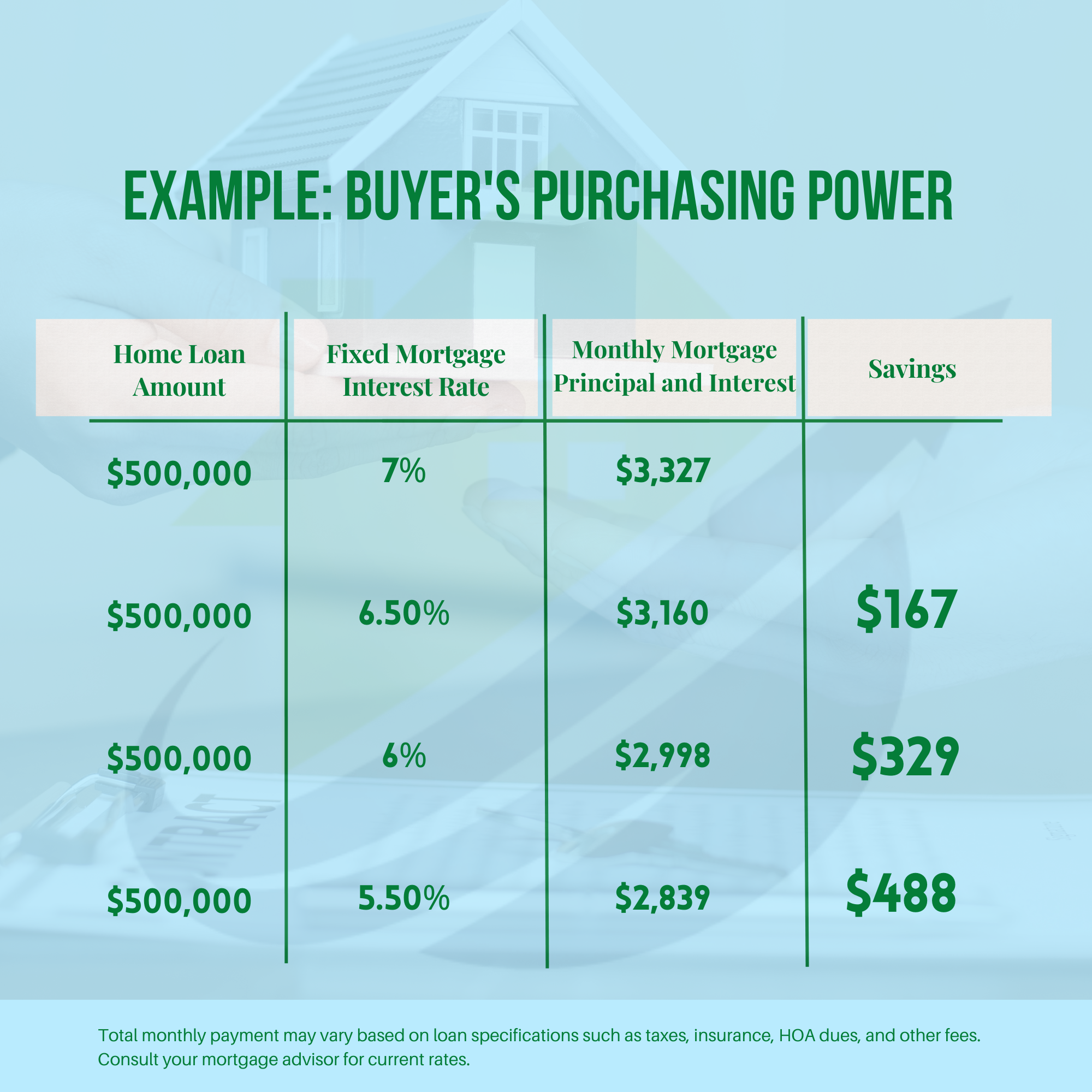

A 1% or even a 0.5% change in mortgage rates can have a substantial impact on your monthly payments. Obviously, rates are moving between 6% and 7% throughout the year. Moreover, it’s essential to understand how these fluctuations affect your home buying power in the context of changing rates.

You might be tempted to delay your home-buying plans, hoping that rates will fall. However, this can be risky, as no one can accurately predict where rates will go, and attempting to time them can be challenging. Furthermore, Housing Economist Lisa Sturtevant at Bright MLS explains, “It is typically a fool’s errand for a homebuyer to try to time rates in this market…But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

Benefits of Homeownership Amid Changing Rates

Owning a home comes with numerous benefits. It includes stability, tax advantages, and the potential for appreciation. As a homeowner, you have the opportunity to build equity in your property, which can serve as a financial safety net for future needs. Moreover, homeownership provides a sense of accomplishment and pride in having a space to call your own.

Growing Equity in a Home

Building equity in a home is one of the most significant financial advantages of homeownership. As you make monthly mortgage payments, a portion goes toward reducing the principal balance of your loan, which increases your equity. Over time, as property values appreciate, your equity can grow even more, providing you with a valuable financial asset.

The Importance of Expert Advisors in a Changing Rate Environment

Given the volatility in mortgage rates, it’s crucial to rely on expert advisors to explore your mortgage options, understand the factors that impact mortgage rates, figure out your home buying power, and plan your home-buying budget accordingly. Thus, they can offer advice tailored to your specific situation and goals helping you make informed decisions.

Get your copy of the First-time Home Buyer Guide for FREE. Click here.

Buydown Programs

Don’t forget, there are permanent and temporary buydown programs available to you as well. With a permanent buydown program, you can pay up front for a permanently lower rate. This can be covered by you, the seller, or even lender credit. There are also temporary buydown programs available that can lower your rate for up to 3 years. Read more about our temporary buydown programs here.

The Takeaway

Your ability to buy a home, or home buying power, could be impacted by changing mortgage rates. If you’re considering making a move, partner with a trusted real estate agent and lender to develop a robust plan. With their guidance, you can navigate the complexities of the market and make the most of the home buying power available to you in the face of changing rates.