California also known as the Golden State is one of the most expensive states to live in the US. Home prices are unbelievably high in cities like San Francisco, San Diego, and San Jose. Therefore, if you want to buy a bigger home for your family in the Golden State, and it costs more than $726,200, you can opt for either a high balance loan or a jumbo mortgage. At present, the standard conventional loan limit in California is $726,200. This means if you exceed this amount you’d need jumbo financing to buy a property.

However, it is crucial to understand that in some high cost areas of California, limits are also higher. This means a high balance loan will work in cities like Alameda, LA, NAPA, Orange, Santa Clara because the loan amounts here are allowed up to $1,089,300. Read on to learn about both programs in detail.

High Balance Mortgage Loan

This type of loan surpasses the national baseline that conforms to the loan limits. However, it falls within the local conforming loan limits for your county. A high balance loan conforms to Freddie Mac and Fannie Mae.

The lending requirements for this loan are:

- A credit score of at least 620 (however, it varies on your cash reserves and the size of the down payment)

- A down payment of at least five percent of the property’s appraised market value should be made

- Your DTI (debt-to-interest) ratio should not exceed 45 percent

However, you must meet some extra stipulations if you want to qualify for Fannie Mae high balance mortgage loan. These include:

- All applicants should have credit scores

- The borrowers of high balance loans can’t access the 3 percent down payment loans offered by Fannie Mae.

Jumbo Mortgage

A jumbo mortgage is a loan taken out for a large amount- an amount that exceeds the conforming loan limit of your local county. However, unlike high balance loans, a jumbo mortgage is non-conforming. However, it is ineligible for purchase by Freddie Mac or Fannie Mae.

Borrowers can easily get jumbo loans for different properties, including log homes and high-rise condos. Please note that the jumbo mortgage rates vary frequently and widely.

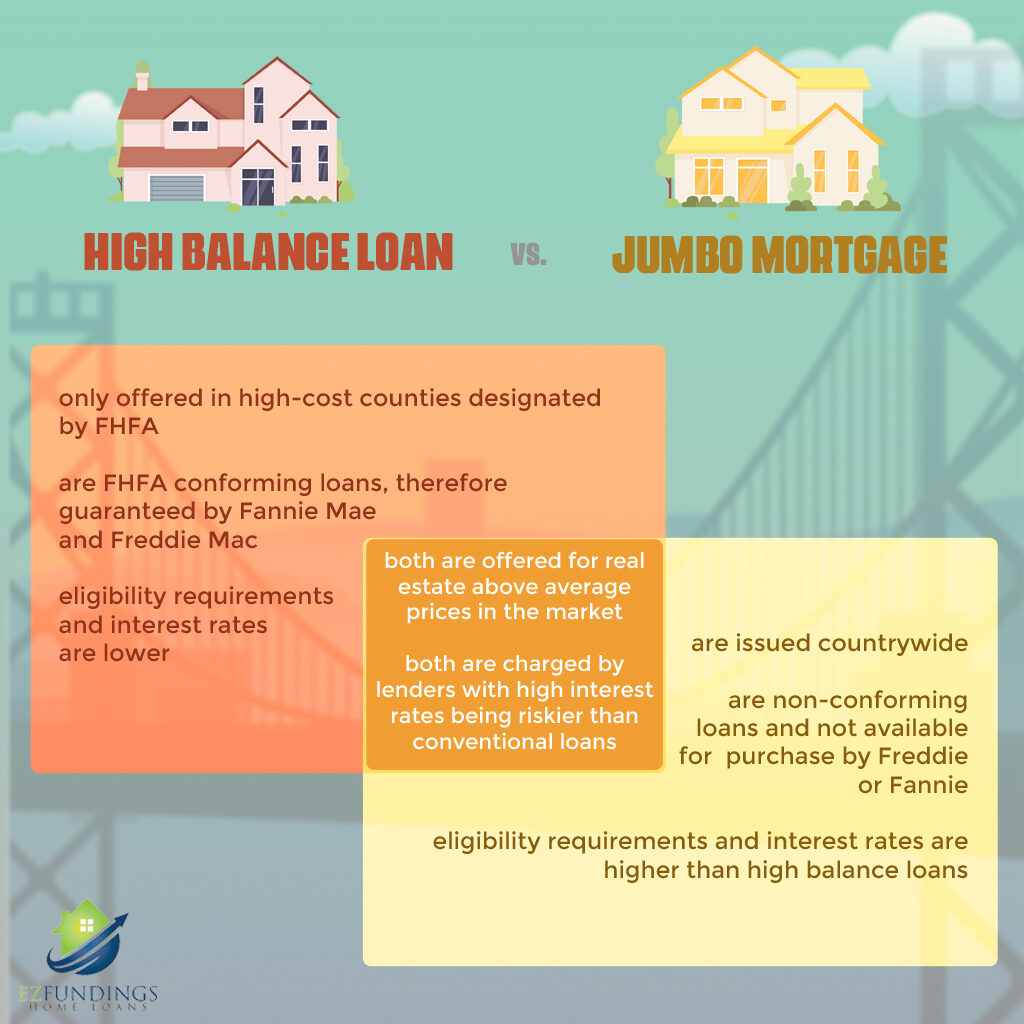

Similarities between High Balance Loan and Jumbo Mortgage

Though high balance and jumbo loans are distinct, the traits they share include are:

- Both are mortgage loans offered for real estate that is above the national county limit.

- Lenders consider both loans riskier in comparison to conventional loans. Hence they may charge high-interest rates on them.

Difference between the Two Loan Programs

The differences between high balance and jumbo mortgage loans are:

- Jumbo loans are issued countrywide. However, high-balance loans are only offered in high-cost counties designated by FHFA.

- Jumbo mortgage loans are non-conforming loans and not available for purchase by Freddie or Fannie, while high balance loans are FHFA conforming loans. As high balance mortgage loans are FHFA conformed, they are guaranteed by Fannie Mae and Freddie Mac.

- Moreover, as eligibility requirements and interest rates on high balance loans are lower than on jumbo loans, it makes high balance loans more preferable.

For more information or assistance with choosing the best loan program, get in touch with us. Our experienced mortgage experts can help you make an informed choice.