If you are purchasing a home on a mortgage that too for the first time, your lender may order a home appraisal. This is a vital aspect of the home buying process. Read on to learn about home appraisal in detail.

Home Appraisal- What is it?

It is an unbiased professional opinion of the property’s value. In other words, it is an independent and transparent estimate of the fair market value of what a property is worth. Lenders order such an appraisal to assess the property’s fair market value. It also ensures that the mortgage loan amount requested by the potential property buyer (borrower) is appropriate.

This appraisal most often includes the following:

- The recent sales information of similar properties

- The property’s current condition

- Its location

How is the House Appraised?

The lender selects and hires the home appraiser in most cases, while the mortgage applicant/borrower pays the home appraisal fee. This will likely cost you around $300 to $400. The person hired for an appraisal is licensed, certified, and highly trained. Rest assured, they know how to determine the home’s value fairly and objectively. The appraiser’s opinion of the home’s value is informed by rigorous training, numerous tests, and years of job experience.

Moreover, the appraiser also substantiates every finding in the home appraisal report that could otherwise influence the property’s value for sale. Besides this, appraisers and appraisal management companies are heavily regulated. Therefore, they work hard to provide an impartial and factual opinion. And besides, biased or misleading reporting can lead to severe consequences. Therefore, appraisers ensure that they are fair and keep their prejudice and judgments out of their work.

What is Included in a Home Appraisal Report?

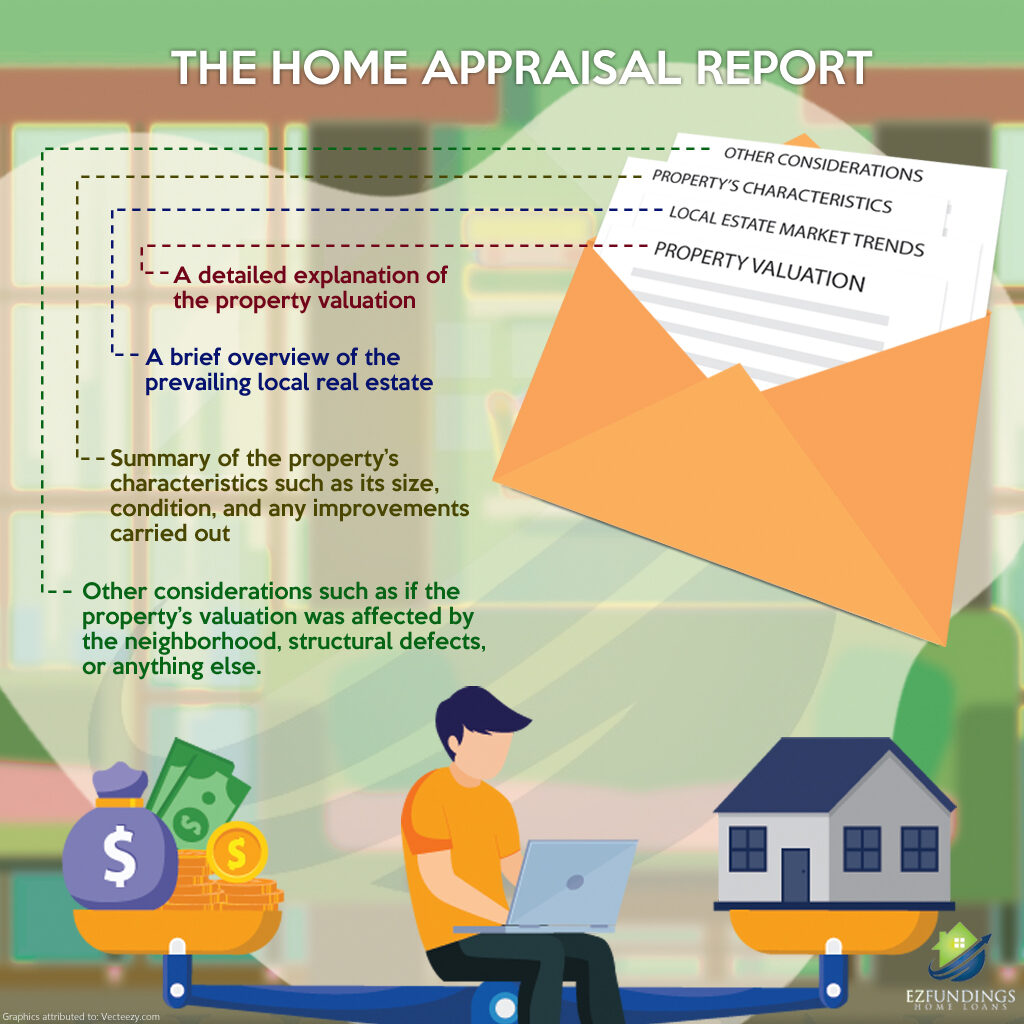

Typically, this kind of report includes the following information:

- Property valuation

- Overview of local real estate market trends

- Summary of the property’s characteristics

- Other considerations

Why is a Home Appraisal Needed?

A home appraisal is critical and needed because of different reasons. For example:

- It protects the buyer, thereby ensuring that you don’t overpay for a property

- It helps identify zoning issues with the property

- Allows the mortgage lender to gauge the risk of making a loan. It helps the lender to be sure about the home’s actual worth. This is because it serves as collateral in case the borrower defaults. So, a home appraisal ensures that the lender isn’t approving a bigger loan compared to the property’s actual worth.

For more information or home loan process assistance, contact us today. We are experts in this domain and can provide you quality guidance needed to make an informed home buying decision.