If you plan on buying or refinancing a home, your realtor may request that you obtain pre-approval for a loan before submitting an offer (click and read “The Power of a Pre-Approval for Home Loan“). However, it may be wise to consider conditional loan approval if your offers are consistently being rejected. Let’s explore what exactly home loan conditional approval entails, as well as the conditions that must be met in order to obtain it.

Conditional Approval Explained

Conditional approval serves as an intermediary step between submitting a mortgage application to the underwriter and obtaining final approval. Lenders assess your income, credit report, and assets before issuing conditional approval. Underwriters then conduct a thorough examination of your financial information before potentially granting conditional approval.

It falls short of verified or final approval although conditional approval is more substantial than prequalification. It is granted only after the underwriter verifies your loan information and deems you capable of repayment. Hence, the lender may impose certain conditions that must be satisfied before the loan can proceed once you receive conditional approval.

In essence, conditional approval indicates that the mortgage underwriter is mostly satisfied with your application. However, there may still be some unresolved issues, known as conditions. Meeting these conditions is necessary for the loan to be approved. It is important to note that conditional approval does not guarantee the availability of funds required for the purchase.

What Are the Conditions for a Conditionally Approved Loan?

Conditional loan approvals may have varying requirements depending on the specific case. However, certain themes tend to recur across conditionally approved loans. These commonly include:

- The need for missing or incomplete documents required for the loan funding process.

- Provision of a copy of the homeowner’s insurance policy.

- Verification of assets and income through bank statements and check stubs.

- Verification of income tax returns.

- Proof of mortgage insurance.

- Explanation of recent deposits or withdrawals.

- Appraisal of high-value assets, such as jewelry and art.

Conditional Loan Approval vs. Pre-approval

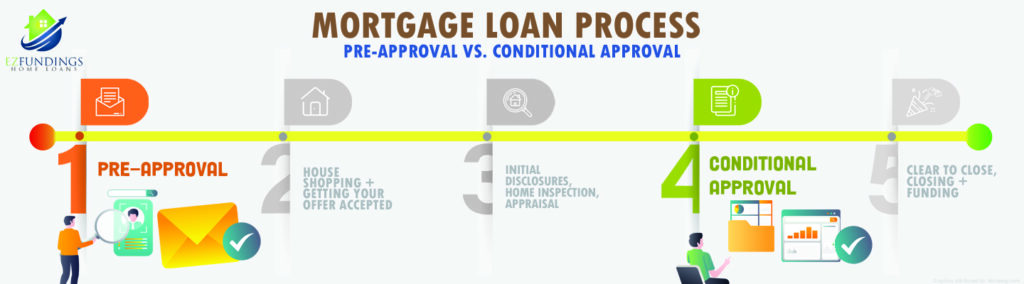

Potential home buyers often confuse the conditional approval process with the pre-approval process. However, the main difference between the two is that pre-approval occurs before the underwriting process and is not as strict as conditional approval. On the other hand, conditional approval comes after pre-approval and is a stronger indication of approval for a loan. Meeting the conditions of conditional approval increases the likelihood of loan approval and makes it more attractive to sellers.

If you are interested in learning more about home loan conditional approval and its conditions or need assistance with the home loan process, please do not hesitate to contact us.