Unleash the power of homeownership with EZ Fundings Home Loans and their sensational Temporary Buydown Programs! Say goodbye to high interest rates and hello to low mortgage rates in 2023 as low as 3%. Yes, you read that right, 3%! And the best part? You won’t even have to pay a penny for it!

Power of Seller Concessions

With the power of Seller Credit or Seller Concessions, sellers who are eager to sell their homes can lower their prices. Thus, it make possible for you to buy your dream home at an unbeatable interest rate. Plus, the recent surge in home prices gives you the chance to own your dream home at a price lower than list. Moreover, an instant increase in home value once the market shifts again! The seller nets the same, and you get a temporary lower rate. It’s a win-win for everyone because of low mortgage rates in 2023!

Step into the Buyer’s Market of the 21st century where your homeownership dreams can become a reality. Want to know more about the advantages of buying now? Click here to read Why Now Is Still A Good Time To Buy!

The EZ Buydown Programs

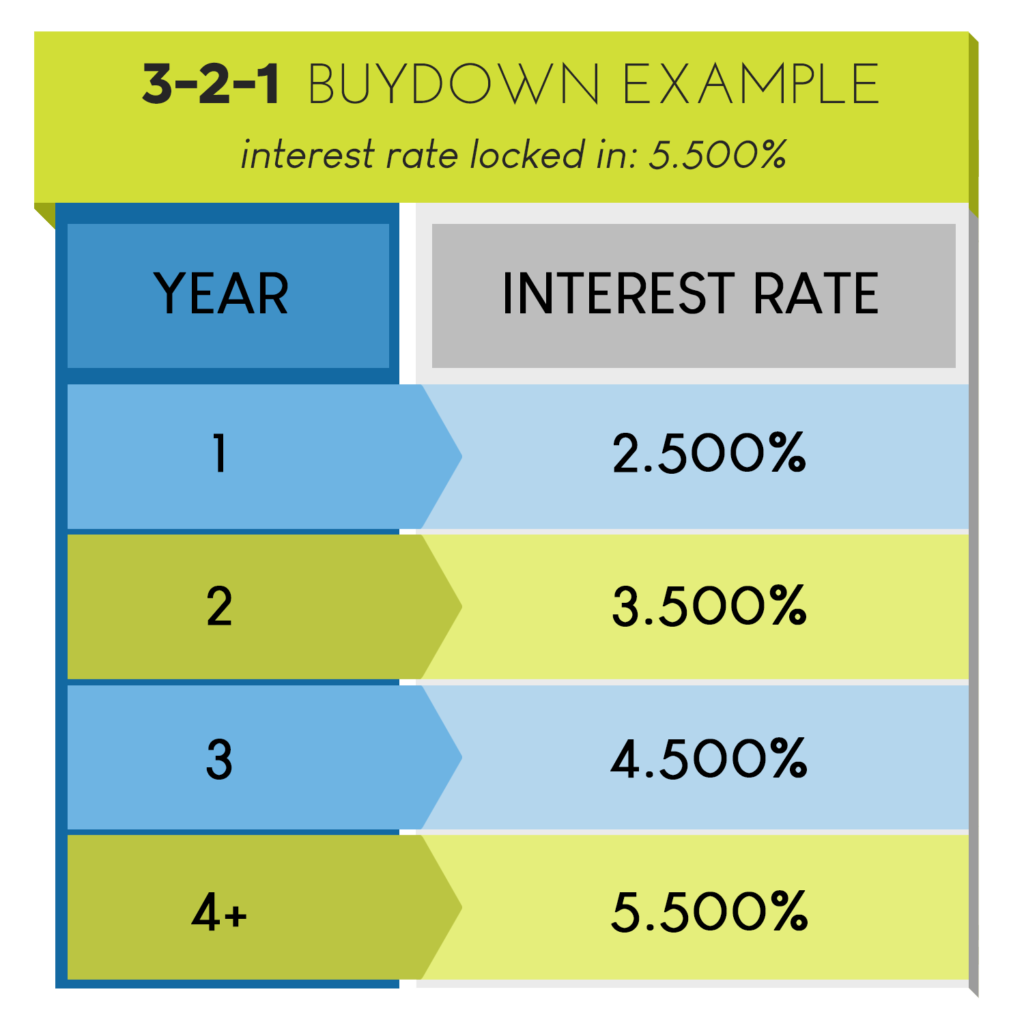

3-2-1 Buydown Program

“How does this work?” you ask. Our popular 3-2-1 buydown program reduces your interest rate by 3% in the first year, 2% in the second year, and 1% in the third year, and then reverts back to your base rate.

For example, if you qualify for a 5.5% interest rate loan, you’ll enjoy a jaw-dropping 2.5% interest rate in the first year, 3.5% in the second year, and 4.5% in the third year, saving you thousands and thousands in the process. And don’t worry about the interest rate going back up after the 3rd year. By that time, interest rates are expected to go down, giving you the chance to refinance and secure a permanent low rate, or move to a bigger property and rent out the one you just bought.

Get your copy of the First-time Home Buyer Guide for FREE. Click here.

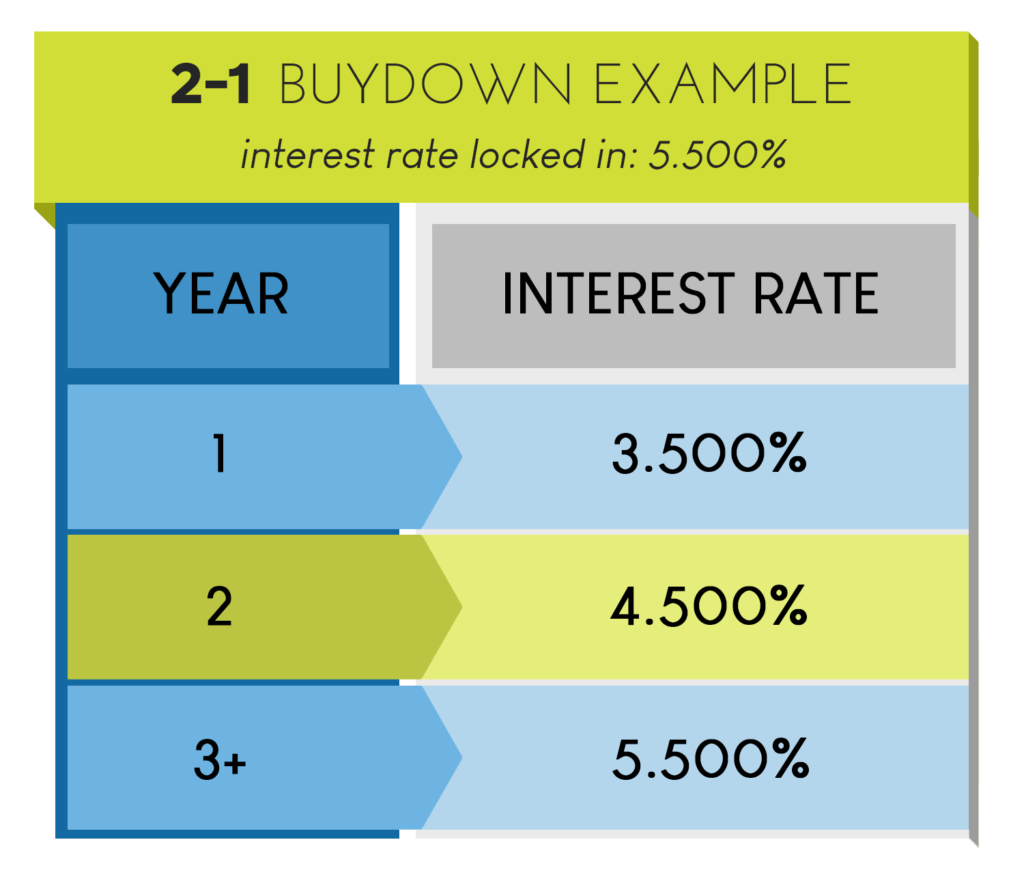

2-1 Buydown Program

Easing into your mortgage payments has never been easier with our Temporary Buydown Programs.

We even offer a 2-1 rate buydown program and a 1-0 rate buydown program for even more savings! These programs are similar to the 3-2-1, but with shorter terms. For example, if you qualify for a 5.5% interest rate loan, you’ll enjoy a beautifully low rate of 3.5% in the first year, and a 4.5% in the second year. By the third year, you’ll be back to the original rate you qualified for at 5.5%

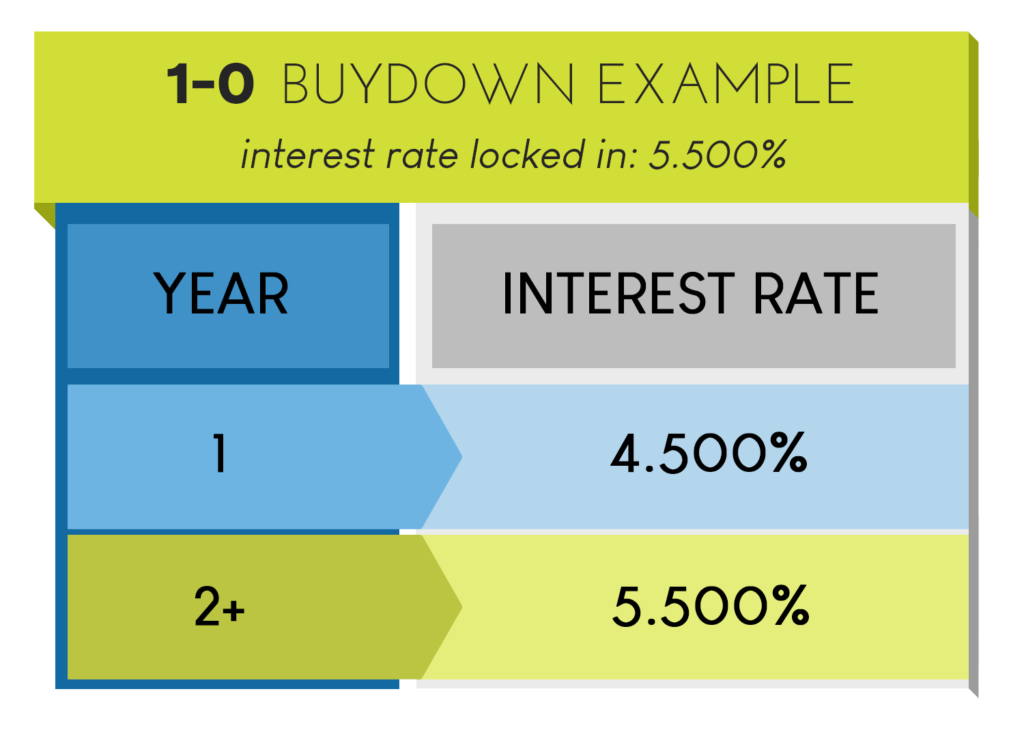

1-0 Buydown Program

The 1-0 buydown program lowers the original rate by 1 for the first year. For example, if you qualify for a 5.5%, you will enjoy the benefit of a 4.5% for the first year. After that, it goes back to the original 5.5%.

The cost of the program is covered by either seller or lender credit, and it is put into an escrow account to make up the difference in the payment due to the rate buydown reduced payment. For example, if your payment is reduced by $500/month due to the rate buydown, the $500 will come from that escrow account to complete the payment. If you choose to refinance before the term of the program is up, whatever money is left in the escrow account is applied as a principal reduction. It’s a win-win all around!

So, what are you waiting for? Get in touch today to learn more about how our Temporary Buydown Programs can benefit you and turn your homeownership dreams into a reality!