Most people use the terms preapproval and prequalification interchangeably. But actually, they are pretty different. And that is precisely what we’ll focus on in today’s blog post. Through here, let us help you understand the difference between the two. After that, you can take the steps towards homeownership confidently.

What is Prequalification?

Prequalification is an early step in the homeownership journey. This is the step where the borrower works with the loan officer/lender to get a quick estimate of what you might be able to borrow. This is based on the information you provide, such as your:

- Credit

- Debit

- Income

- Assets

The lender reviews your financial picture and provides you with an estimate of the home you can afford. Moreover, prequalification gives you an opportunity to learn about different mortgage options. It also finds the right option that fits your needs and goals.

Besides this, a mortgage prequalification indicates that you can be approved for a mortgage if you apply for it formally. Therefore, it is probably the first step you can take to start your home buying journey.

What is a Preapproval?

A mortgage preapproval is different from prequalification. This is a written statement or a letter specifying the maximum amount of the loan and the commitment of the lender to fund your loan if your financial situation remains stable.

This step is above prequalification. It requires more legwork. A preapproval involves a thorough investigation of the borrower’s assets, income, credit history, debts, and rental history. As the information is verified, it confirms your creditworthiness and gives a concrete idea of how much the borrower can afford. At this stage, the lender not only determines your eligibility but also determines the maximum loan amount and interest rate.

Mortgage Preapproval vs. Prequalification- Understanding the Difference

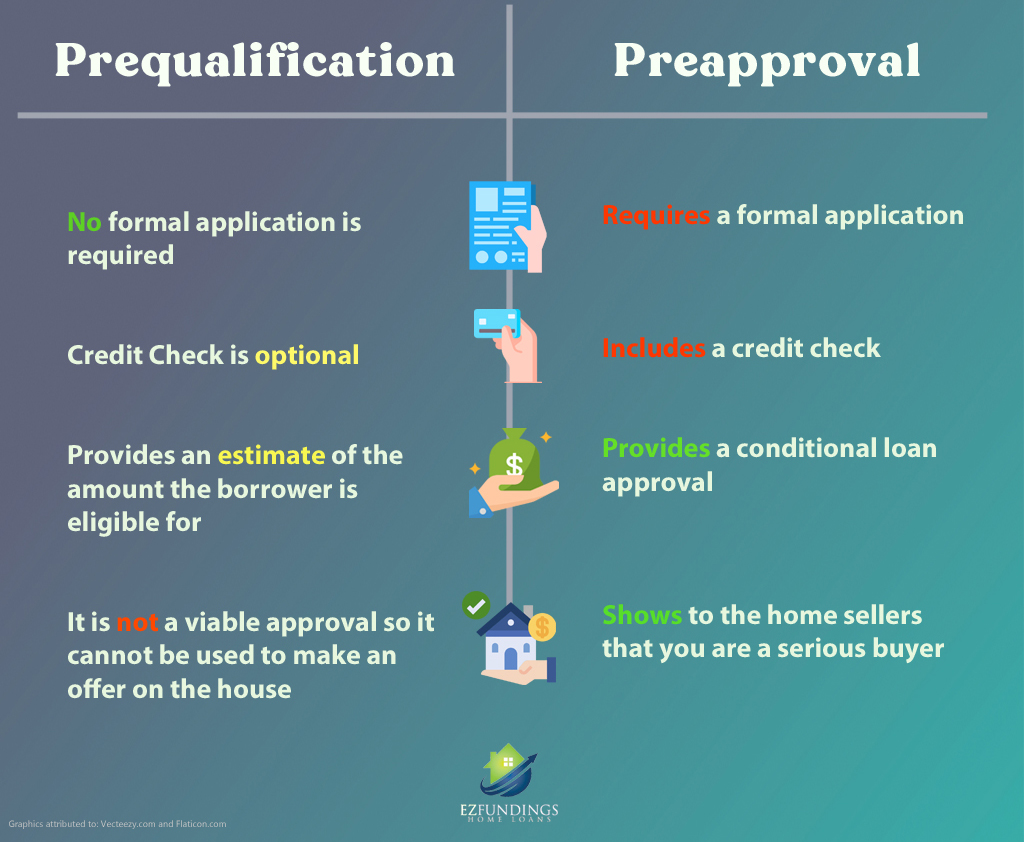

As compared to prequalification, a preapproval carries more weight. It is valued more by the home sellers because, unlike prequalification, which is a cursory review of the borrower’s finances, a preapproval shows that the lender has investigated the finances, credit, bank statements, and tax returns. Therefore, a preapproval shows that you have cleared the hurdles necessary to be approved for a loan up to a certain amount.

Other differences are stated in the table below.

Get a Preapproval or prequalification?

If you are starting your homeownership journey, then it is best to get pre-qualified. This will give you a good idea of how much you might be able to borrow. Please note that prequalification may not always lead to loan approval. Therefore, avoid making firm plans on home buying based on your qualification status.

Likewise, if you are ready to buy a home, skip prequalification and apply for a preapproval. A preapproval is extremely valuable as you can easily make an offer on the house, especially in a competitive market, thereby standing out as a potential buyer.

If you are a first-time home buyer and you have other queries, you can check some frequently asked questions here. You can also reach us and we’ll make things EZ for you!