Backed by the Department of Veteran Affairs, VA loans offer tons of benefits as an active duty service member and veteran that wish to become homeowners. Read on to learn how you can benefit, as long as you meet the criteria.

But, before we review the benefits, it is essential to know the eligibility requirements. You can apply for the VA loan if you have:

- Served for 181 days of active duty during peacetime

- Served for 90 days of active duty during wartime

- 6 Years of service in the National Guard or Reserves or served 90 days until Title 32 Orders

- You are the spouse of a service member who has passed

- Discharged for hardship, convenience of the government, reduction in force, a medical condition or service-connected disability, or an early-out.

If you’re unsure of your service status, it’s best to speak to one of our VA Lenders and see where you stand.

Remember that your VA home loan program eligibility never expires. This means if you’re an eligible active duty service member, you can apply for the VA loan anytime you want.

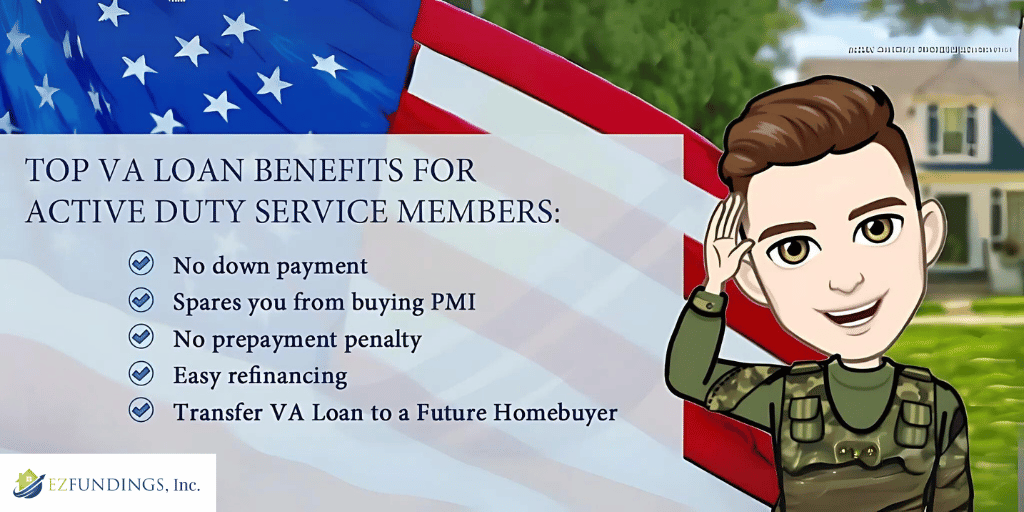

Top VA Loan Benefits for Active Duty Service Members

Here’s how active duty service members benefit from VA loans:

No down payment

One of the benefits as an active duty service member is no down payment needed/ Eligible borrowers don’t have to worry about making a down payment with a VA loan. In other words, you can finance your VA loan up to 100 percent of the buying price. You don’t have to pay any percentage of the home price upfront in cash.

It spares you from buying private mortgage insurance

You may have to buy private mortgage insurance in a conventional loan if you make a down payment of less than 20 percent. This protects the lender, if the borrower defaults on the loan. However, eligible VA borrowers don’t have to worry about PMI. This is because no mortgage insurance is required on the VA loan because the government backs them.

No prepayment penalty

Another benefit of a VA loan is that it doesn’t limit your right to sell your property before the loan term is complete. This means you will not be penalized for an early exit. There is absolutely no prepayment penalty and early-exit fee. Hence, you can sell your property whenever you want without any limitations.

Refinancing is easy

When you opt for a VA loan, you can refinance it quickly. There is no restriction on refinancing. In fact, VA borrowers can refinance their existing loan into another VA loan through a special program named IRRL (Interest Rate Refinance Loan program). Also, you have the flexibility to switch from a VA to a non-VA loan whenever you want.

Transfer VA Loan to a Future Homebuyer

Another benefit of a VA loan is that they are assumable. An assumable loan gives you the freedom to transfer your Veteran Affairs loan to another homebuyer. However, the only requirement is that they must be VA-eligible.

Contact us today to learn more VA loan benefits or service assistance. We are experts in the home loan process in California.