Are you planning to buy a home? Is it your first time? Then the chances are that you have many questions on your mind. It can be difficult to make an informed home buying decision for first-time home buyers with so many unanswered questions. But don’t worry, we have you covered. Hence, these are some of first-time home buyer FAQs (Frequently Asked Questions).

Get your copy of the First-time Home Buyer Guide for FREE. Click here.

Is home buying better than renting a home?

When compared, buying is always a better option than renting a home. Some of the many benefits of buying a home are:

- Tax breaks

- Ability to build your equity

- Financial gains

- Appreciation in value

- Security

- A sense of pride

For singles and those getting married, here’s another read about the benefits of buying a home over renting.

Am I ready for the big purchase?

You shall be ready if you:

- Have a steady job

- Have you had a steady job for the last two or three years

- Have a reliable income

- Have a positive record of paying bills

- Have saved for a down payment

- Can afford to pay for home mortgage, taxes, and insurance

Will my credit score impact my purchasing power?

Well, it does. A credit score is an overview of your financial standing. It summarizes your credit history. Your credit score is used to determine if you qualify for the loan type you have applied for and at what interest rate. Thus, the higher your score, the greater your chances of loan approval for home buying with a low-interest rate.

Therefore, we advise potential first-time homebuyers to collect their credit reports from all three credit bureaus (Equifax, Experian, and TransUnion) and check them thoroughly for inaccuracies, errors, and mistakes. Moreover, get them fixed to improve your credit rating. This will help you put your best foot forward with lenders and qualify easily. It’s beneficial to you!

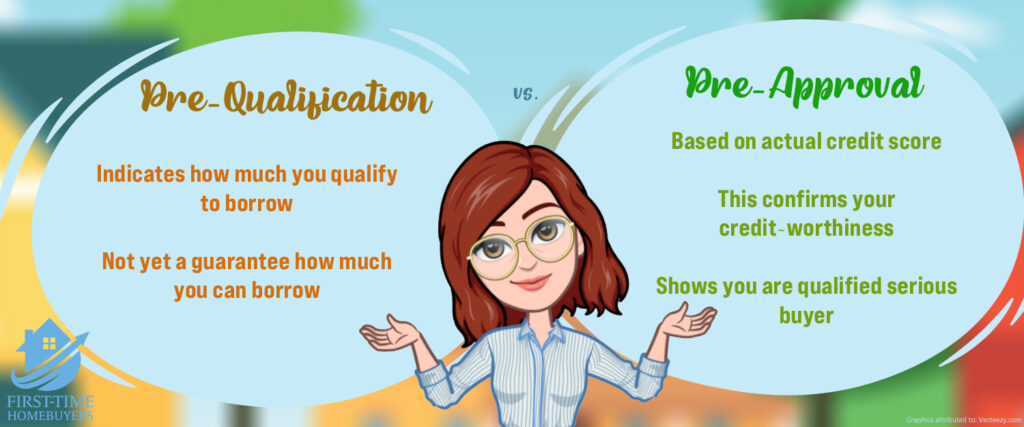

Is there a difference between pre-qualification and pre-approval?

Yes. The basic difference between the two is that a pre-qualification for a home mortgage indicates how much you might qualify to borrow. However, how much you can borrow is not guaranteed because no information has been verified.

Furthermore, a mortgage pre-approval is based on your actual credit score. This means it confirms your creditworthiness to the seller and shows you are a serious and qualified home buyer. Definitely, it further increases your chances of securing the purchase. You want to make sure you get a pre-approval letter.

Can I buy a home with no money down?

In general, most lenders offer conventional loans. So, if you apply for a conventional loan, you will have to make a down payment of 20 percent or provide private mortgage insurance if you can’t pay 20 percent down.

However, if you are a veteran or a spouse of a veteran, then you can apply for a VA loan which requires no down payment. Likewise, an FHA loan may be a good choice for you as the down payment for this loan is only 3.5 percent.

I hope you learn something about some first-time home buyer FAQs. If you have any other question in mind, feel free to contact us. Our experienced team can answer all your questions to your complete satisfaction and provide you with quality assistance making the first-time home buying process quick and straightforward.