When you apply for an FHA loan or make a down payment of less than 20 percent on your conventional loan, you, the loan borrower, will have to provide mortgage insurance. Read on to learn about this in detail.

Get your copy of the First-time Home Buyer Guide for FREE. Click here.

Mortgage Insurance- What is it and Who Pays It?

Mortgage insurance is primarily designed to protect lenders if borrowers default on their loans. Hence, you (the borrower) must pay for private mortgage insurance on a conventional loan if you can’t make a 20 percent down payment.

Similarly, you will have to pay for mortgage insurance on an FHA loan even though the US Federal Housing Administration backs it. However, this is not a requirement on VA loans. But you have to pay an extra fee to protect lenders in case you default.

It is important to understand that usually, when you buy an insurance plan, it is designed to cover you from losses. However, this insurance provides the lender with coverage, not the borrower. Hence, the lender is covered if you (the loan borrower) are unable to pay back the mortgage for any reason, such as:

- You default on payments

- Fail to meet your contractual obligations

- And any other reason that may prevent you from paying back the mortgage on time

Now that you know what it is, let’s dig deeper.

How does this work?

In general, you will have to pay mortgage insurance if you pay down less than 20 percent on your property purchase. This insurance protects the lender because the lender takes more risk in giving you a mortgage when you invest less in the home upfront.

Put simply: this insurance works by giving lenders adequate financial security to approve the loan for the borrower that doesn’t put at least 20 percent down. Hence, it lowers the lender’s risk of loss in the same way as a down payment does.

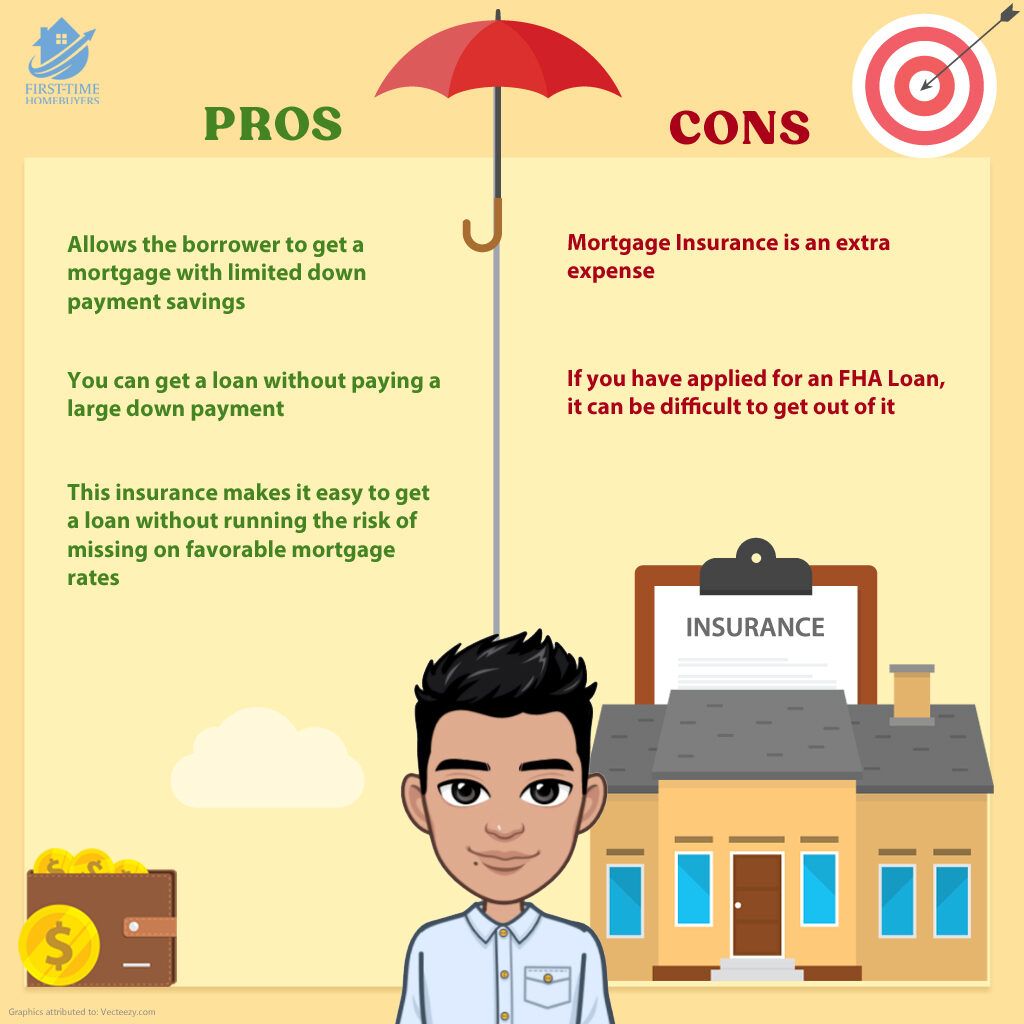

Pros and Cons

Though mortgage insurance benefits the lender, it also serves a purpose for the borrower. It allows the borrower to get a mortgage with limited down payment savings. This truly helps because putting down 20 percent is challenging. This is true in today’s time when home values continue to skyrocket, making it extremely difficult for people to realize their homeownership dream. Therefore, when you pay for mortgage insurance, you can get a loan without paying a large down payment.

Another benefit is that this insurance makes it easy to get a loan without running the risk of missing on favorable mortgage rates. Unless of course, you are willing to wait until you have adequate money to make a 20 percent down payment but lose the opportunities of advantageous rates.

But let’s not forget mortgage insurance is an extra expense. It can be difficult to get out of it if you have applied for an FHA loan. However, if you have a conventional loan, you can get rid of it by paying down your loan. Please note that under the HPA (Homeowners Protection Act), lenders must cancel the said insurance if the borrower’s balance reaches 78% of the property’s original purchase value or when they are halfway through their amortization schedule.

Contact us for more information about mortgage insurance or assistance with the home loan approval process. We can help you evaluate your options and make an informed decision.